Best Credit Cards for Bad Credit in April 2024. Discover it® Secured Credit Card: Best Overall. Credit One Bank® Platinum Visa® for Rebuilding Credit: Best for No Deposit. OpenSky® Plus Secured Visa® Credit Card: Best for No Credit Check. Bank of America® Unlimited Cash Rewards Secured Credit Card: Best for Cash Back.. Bad credit describes an individual's credit history when it indicates that the borrower has a high credit risk . A low credit score signals bad credit, while a high credit score is an indicator of.

No credit history versus a bad credit score Refresh Financial

Bad Credit Mortgage Toronto Bad Credit Mortgages Toronto Manny JoharManny Johar

How to Get a Loan with Bad Credit History Cashalo

Best Ways To Fix Your Bad Credit History Foreign Policy

Tips to Fix Your Bad Credit History Best Personal Finance Blog Law Blog Finance Care Online

Unsecured Credit Cards Bad/NO Credit & Bankruptcy O.K Unsecured credit cards, Bad credit

Trailer Finance with Bad Credit Finance One

The problem of Bad credit history can be by using Installment loans

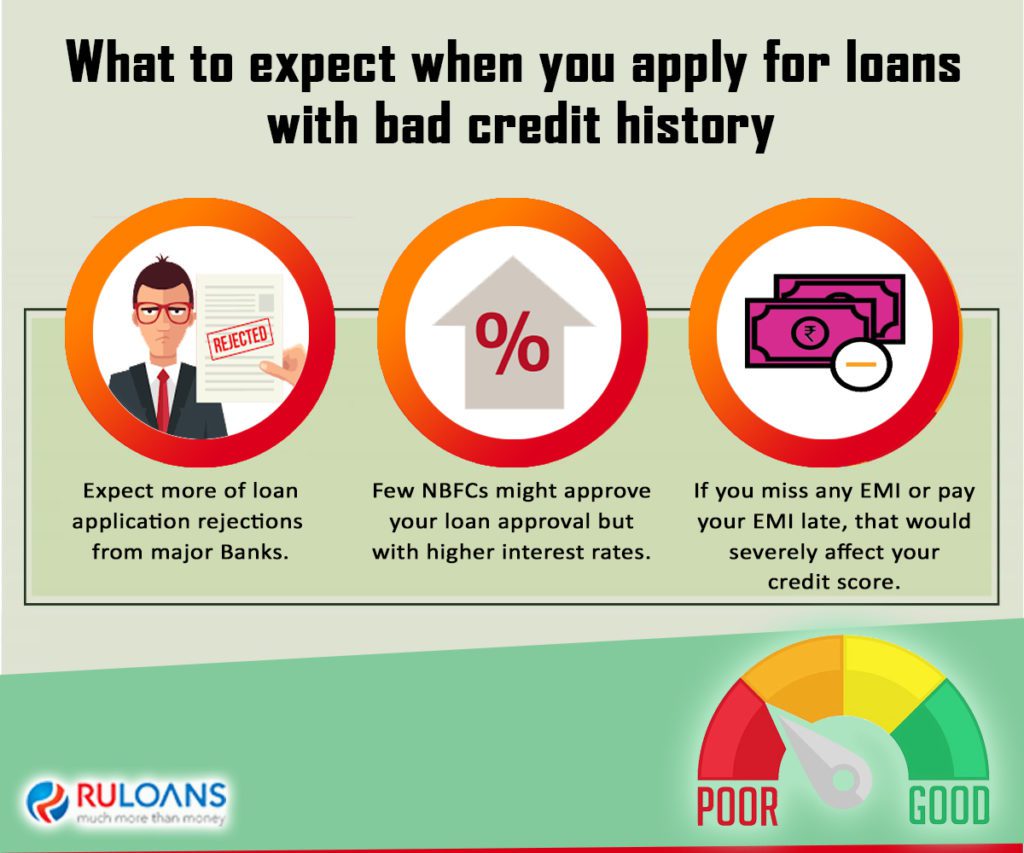

What to expect when you apply for loans with bad credit history

Discover how to Get Financing Despite a Bad Credit History Modern Woman All Over the World

1St Time Buyers With Bad Credit Direct Tv Bad Credit

How to deal with “bad credit”—or no credit—when you want to buy a home Consumer Financial

What Is Bad For Your Credit Score? Peachy Loans

Option to Deal with Bad Credit History to Get Contract Phones

How Your Bad Credit History Effects Your Chance Of Getting A Loan YouTube

How To Help Bad Credit Animalrepair25

Cure your Bad Credit Pains with TheCreditRX . ad Babushka's Baile

Best Business Loans for People with Bad Credit GFORCE FUNDING

Is it Still Possible to Live with Bad Credit History? Qarar

Bad Credit Mortgages Home Trends Magazine

Here is a list of our partners and here's how we make money. A bad credit score generally falls below 630 on the common scale of 300-850. Scores of 630 to 689 are considered fair credit in.. What causes bad credit? Failing to stick to a credit agreement. Declaring bankruptcy. Choosing a credit card or agreement that is unaffordable. Being the subject of a County Court Judgement (CCJ) Only paying the minimum each month. Identity theft. Having no credit history. Consistently spending up to your credit limit.